Sinking Fund Charts

Do you have stuff to save for but don’t know where to start? Give yourself a visual with our Sinking Fund Charts! A visual will help keep you motivated and give you focus.

Sinking Funds are an excellent tool to use to prepare for expenses that are not a part of your regular monthly spending plan.

What Is A Sinking Fund?

A Sinking Fund is a fund formed by setting aside money for the gradual repayment of a debt or replacement of a wasting asset.

It’s like a savings account for a very specific purpose.

What Kind Of Sinking Funds Should I Start?

You can really create a sinking fund for anything and everything!

Just don’t have too many going at the same time or you might end up taking years to get anywhere.

Keep the basics:

- Car Replacement, Maintenance, and Repairs

- Home Maintenance

- Vacations

- Gifts

- Christmas

- Clothes

- Yearly Insurance

- Emergency Fund

… and then add in some FUN stuff too!

Sinking Fund Chart Supplies

This post contains affiliate links. When you purchase through an affiliate link, we receive a small commission at no additional cost to you. Disclosure.

- Printer

- Card Stock

- Sinking Fund Chart Printables – found below

- Colored Pencils

How To Use Sinking Fund Charts

- Print the Sinking Fund Charts, of your choice. When you print, I suggest using Card Stock for durability.

- Determine how much you need to save for your sinking fund and write the amount on the Goal line.

- Record the date you would like to have your sinking fund fully funded.

- Divide your saving goal by 10.

- Write each increment on the lines shooting off the graphic with the smallest on the bottom. If you plan to save $15,000, you would write $1500 on the bottom line, $3000 on the next line, etc.

- As you save, color in the lines! Each increment consists of 10 lines to fill in. If you plan to save $15,000 and each increment represents $1500, each line would represent $150. For every $150 you save, color in a line.

- Make your Sinking Fund a part of your monthly budget! If you plan to save $15,000 and you want to save it in 10 months, you need to incorporate $1500 a month into your spending plan.

Sinking Fund Chart Printables

Jump To The Sinking Fund Chart You Want To Print Here

Learn More About Each Sinking Fund Chart Here

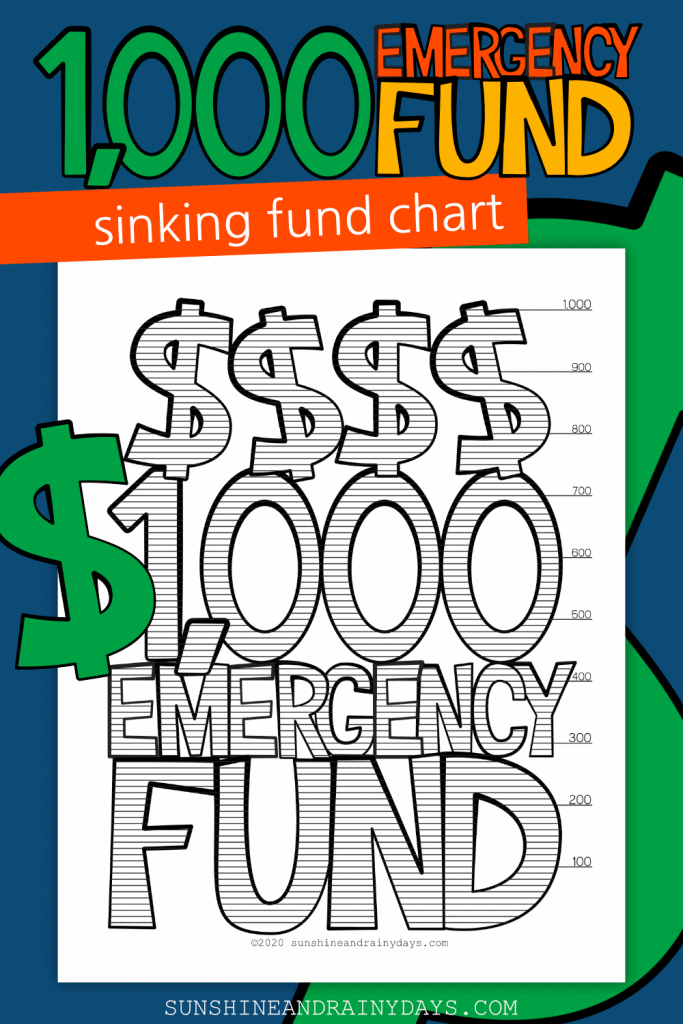

$1,000 Emergency Fund Chart

The $1,000 Emergency Fund Chart is here to help you start your journey to financial freedom!

Dave Ramsey’s Baby Step Number One is to start a $1,000 Emergency Fund as FAST as you can! This baby emergency fund is meant to cover unexpected emergencies that come up. The goal is to not have to derail your entire budget to cover financial surprises.

Dave Ramsey says to keep your $1,000 Emergency Fund where you can easily access it, when needed, but not too easy. Perhaps in a checking account at a different bank.

We actually keep our $1,000 Emergency Fund in our regular checking account. Why? We keep it there as a cushion in our account since we do zero based budgeting. We ‘hide’ the $1,000 so it doesn’t show up in our available balance. It’s comforting to know we have it there!

Depending on your spending habits, you may choose to keep your $1,000 Emergency Fund a little less accessible or use it as a cushion in your regular account.

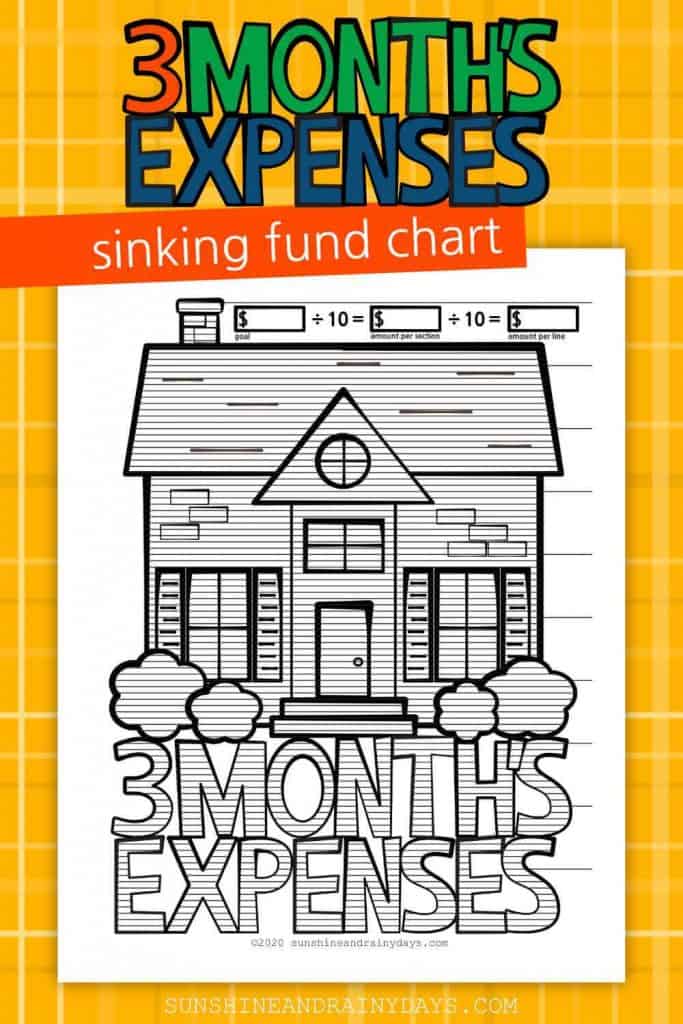

3 Month’s Expenses Sinking Fund Chart

The Three Month’s Expenses Sinking Fund Chart will guide you on your way to saving a nice cushion, in case of emergency. It’s kind of like insurance. You hope you don’t need it but it’s comforting to know it’s there!

Dave Ramsey’s Baby Step 3 instructs you to save 3 to 6 months of expenses for emergencies. By this point, you’ve saved $1,000 in an emergency fund and paid off all debt. Whew! What a feeling! Can you imagine having the security to keep on going with normal life even if a financial surprise pops up? THAT’S what this Sinking Fund is for!

Once you have your Three Month’s Expenses Sinking Fund fully funded, it’s time to stretch it to Six Months! You can do this!

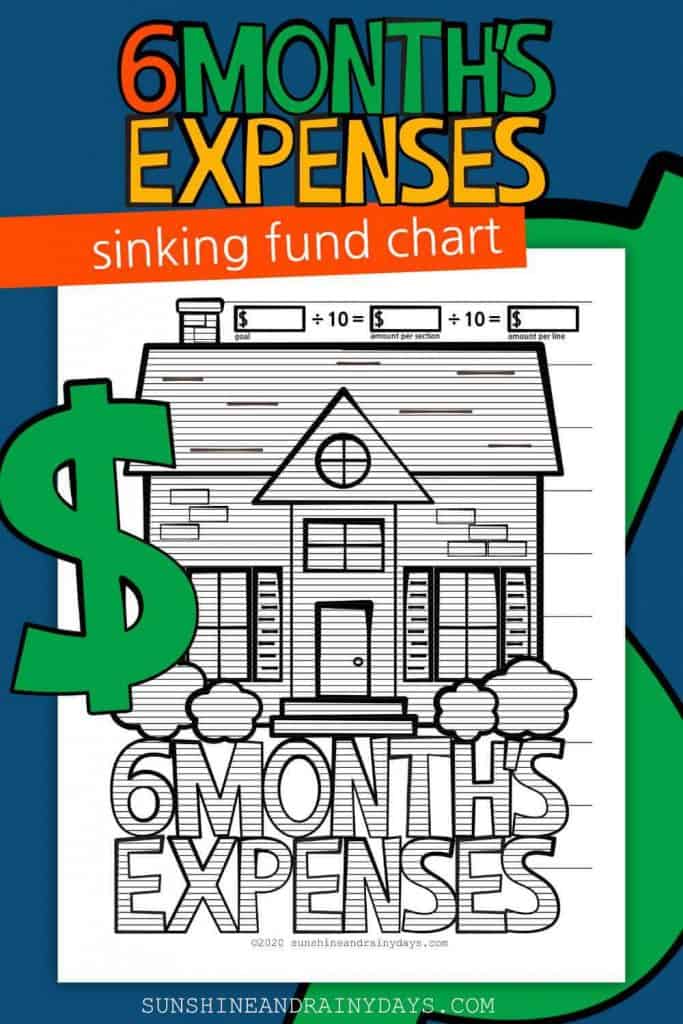

6 Month’s Expenses Sinking Fund Chart

After you’ve saved Three Month’s Expenses, it’s time to move on to the big goal of 6 Months, with our 6 Month’s Expenses Sinking Fund Chart! Imagine the security you will feel when you get to this point!

Dave Ramsey’s Baby Step 3 instructs you to save 3 to 6 months of expenses for emergencies. By this point, you’ve saved $1,000 in an emergency fund, paid off all debt, and have your 3 Month’s Expenses in a savings account. Wow! NOW you’re ready to hit that 6 Month’s of Expenses. Read here to discover how much to save in your 6 month emergency fund.

Annual Car Insurance Sinking Fund Chart

When we moved into an apartment a few years ago, our insurance rates went UP. We were told it was because living in an apartment creates more risk and it would go down again when we moved back into a house.

Imagine my surprise when, just eight months later, we moved into a house in a great part of town and yet that same insurance agent told us our rates would, in fact, NOT go down. He lost my trust and I started the process of pricing out insurance with other companies. Through this process, I discovered we could save quite a bit by making an annual payment instead of month to month. The hard part is, making sure you actually have the money when the annual insurance bill arrives. That’s where an Annual Insurance Sinking Fund Chart comes in!

We found a better insurance rate and made the switch. Our Annual Insurance Sinking Fund has helped us stay on track to pay annually and keep our rates low!

Annual Home Insurance Sinking Fund Chart

If you happen to be one of the few people that does NOT include your homeowner’s insurance with your mortgage, you will love this Annual Homeowner’s Insurance Sinking Fund Chart!

There was a time when I wanted to pay our homeowner’s insurance myself. I didn’t want to depend on our mortgage company to do it. To me, that left room for mistakes to be made.

However, it was tough when the bill came … because I didn’t plan for it. I had purchased a duplex at the sweet young age of 21 and, although I was pretty good with money, there were so many directions for it to go.

These days, our homeowner’s insurance and property taxes are included with our mortgage. So far, so good. If we change back to paying them separately, this Homeowner’s Insurance Sinking Fund Chart will come in handy!

Baby Sinking Fund Chart

Are you ready to start a family but want to make sure your financial life is in order first? A Baby Sinking Fund Chart will give you a great visual to reach your goal of starting a family!

In full disclosure, we did not save a certain amount before we had our first child BUT we did wait until my husband was out of college and had a full time job. It is important to make sure you are financially ready to bring a new life into this world!

This is a super exciting time for you! Kudos for your desire to be financially prepared to bring a child into your family!

Remember, financially prepared is different than debt free. I would never suggest you put off starting a family until you are debt free. Nope! Not gonna find that advice here. I do recommend you are financially prepared! You got this!

Baseball Bat Sinking Fund Chart

It’s been a while since my kids played baseball but I do remember shopping for bats, and they weren’t cheap! A bat is definitely worth creating a Sinking Fund Chart for!

Big expenses, like that sweet bat, can become more doable when you break it down like this on a Sinking Fund Chart!

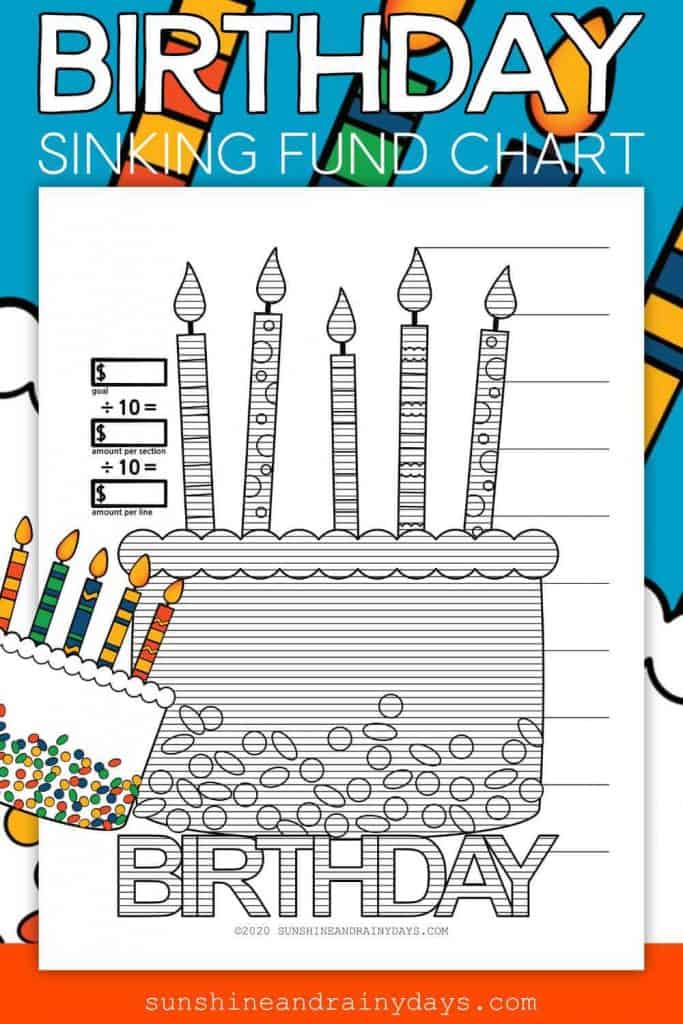

Birthday Sinking Fund Chart

Do you have big plans for your next Birthday? It’s time to start a Sinking Fund to turn those plans into reality! Print this Birthday Sinking Fund Chart and SAVE so your Birthday doesn’t add to your debt.

Black Friday Shopping Sinking Fund Chart

Do you LOVE to shop on Black Friday? The Black Friday Shopping Sinking Fund Chart will encourage you to save CASH for your shopping spree!

Black Friday is my favorite shopping day of the year! Call me crazy but, you guys, I find sooo many deals! There are deals for Christmas gifts, of course, but you will often find great deals on household stuff you need or want. This is your opportunity to SAVE BIG!

But WAIT! You gotta pay CASH to make it a real deal!

Are you ready to shop with CASH in hand? Use the Black Friday Shopping List Printable and get organized!

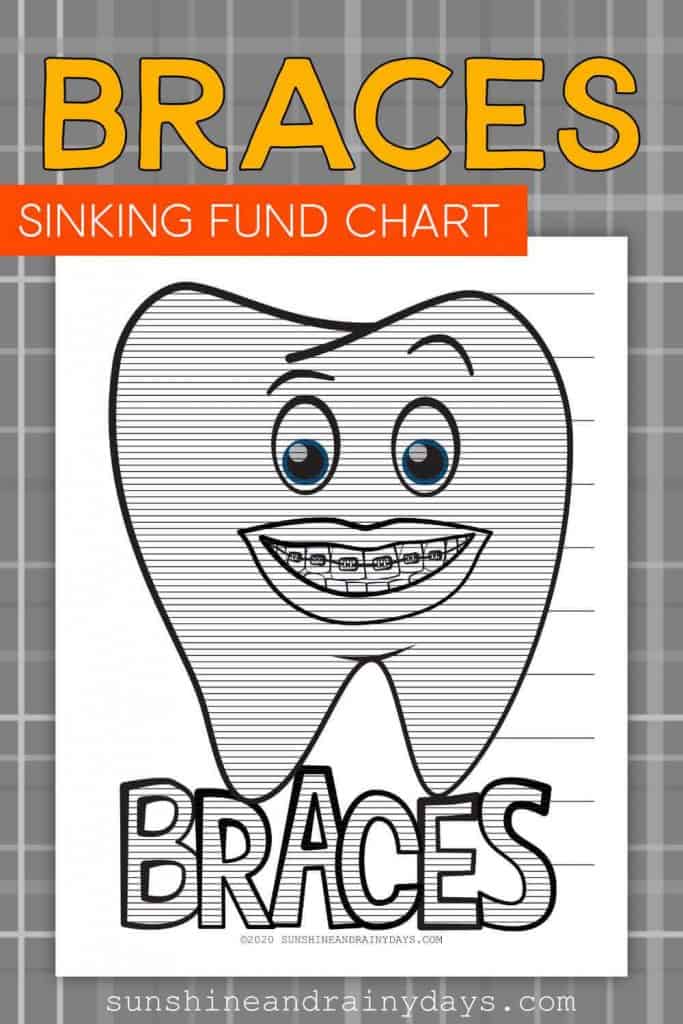

Braces Sinking Fund Chart

Are you ready to make straight teeth a reality for yourself or your child? Our Braces Sinking Fund Chart will give you the visual you need to save for straight teeth!

Paying for braces is almost like paying for a new vehicle! You gotta do the work to research and find the best orthodontist for you or your child. No matter which orthodontist you use, braces aren’t cheap! Sure, you can make monthly payments or add the cost to your credit card but do you really want to? What if you could save cash to pay for braces?

Use our Braces Sinking Fund Chart to do just that!

Bonus: If your orthodontist doesn’t give a cash discount, this is a great time to work the credit card game! With cash saved, charge the orthodontist bill to a card that gives rewards, then promptly pay it off! Win!

Caramel, popcorn, and gum may have to be put on hold for a while but just think about those straight teeth and the confident smile you will have!

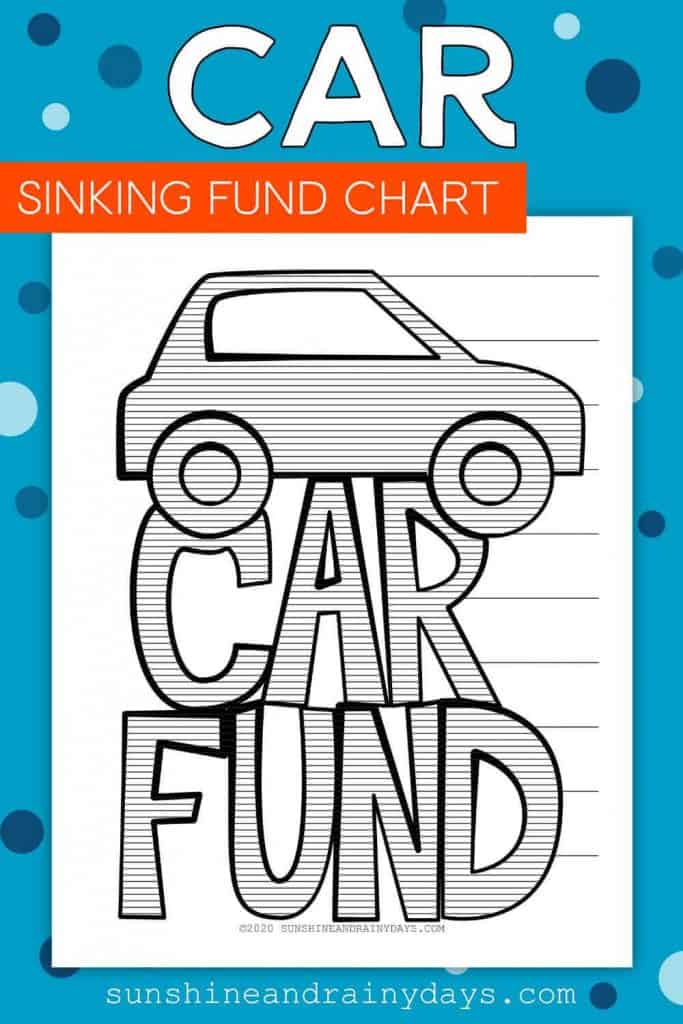

Car Sinking Fund

Whether you are planning to purchase a new car or need a sinking fund for car maintenance, our Car Sinking Fund Chart will attempt to keep you on the road to saving!

Just think of the day a flat tire won’t derail your emergency savings. Better yet, how about the day you pay CASH for a car?

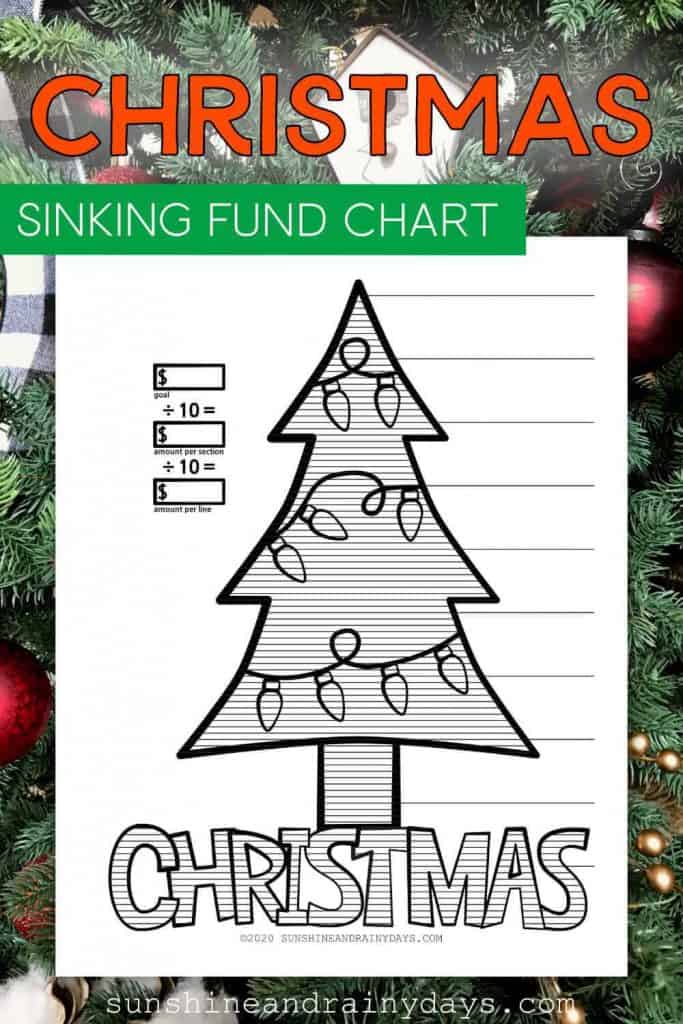

Christmas Sinking Fund Chart

Have you determined THIS Christmas will be different? This is the Christmas you will not go into debt for. THIS Christmas you will pay cash for every gift and call it good!

Christmas comes the same time every year, yet most of us aren’t financially prepared. The Christmas Sinking Fund Chart will give you the visual you need to save and pay cash for your Christmas shopping!

Make THIS Christmas the BEST Christmas yet! Pay cash for every gift you give and rest easy when January rolls around and there’s nothing to pay off!

College Textbooks Sinking Fund Chart

You have College Tuition figured out and now it’s time to focus on those College Textbooks. The College Textbooks Sinking Fund Chart will give you the visual you need to save cash for textbooks!

My daughter is working super hard this summer. She signed up with a temporary agency to do warehouse work and has been working 50 hour weeks. Her goal is to earn enough money to pay for her college textbooks and to have extra spending money for the year. This College Books Sinking Fund Chart is just what she needs to keep motivated to work hard!

Loans may be inevitable when it comes to college but with hard work you can make a BIG dent in the amount you borrow!

I’m SUPER proud of my girl who is motivated to take on a lot of the responsibility of her college costs! It makes us eager to help every way we can!

College Saving Chart Printable

One way we have failed as parents is not saving for our kids’ college education. UGH! We’ve done so much right but we get a fat F when it comes to this.

Thankfully, we are debt free, with the exception of our home. The next few months will be spent saving as much as we possibly can for college expenses. We have a bank account set up but I needed a visual representation of where we want to go. Enter the College Saving Chart!

Maybe you haven’t failed in this area? I am so utterly excited for you! Perhaps you can use our College Saving Chart to save for the extras your student will need. After all, there is always more to save!

If you are in this for the long haul and have plenty of time to save, check out this chart that shows what to save each year to send your kids to college.

Computer Sinking Fund Chart

You want to upgrade your computer or purchase a laptop but you are determined to pay CASH! You plan to save and want to watch your progress on a Sinking Fund chart. The Computer Sinking Fund Chart is here to save the day!

Visions of a MacBook Pro are dancing in my head. Can you believe I have never owned a laptop? They kind of scare me. That mouse, right on the keyboard like that, freaks me out. I’ve tried to use it but it just doesn’t work out quite right. Mouse issues aside, I’m ready! Ready to own my first laptop.

The luxury of working while sitting on the couch appeals to me. Imagine all the things I could accomplish while still in the same room as my family! There’d be no need to seclude myself in the other room while the rest of the family carries on with puns and stories from the day. I could be right smack dab in the middle of it all with my beautiful MacBook Pro!

THAT means I gotta SAVE to make my couch sitting, computer wielding, family participation dreams a reality!

As for that mouse, I plan to purchase a wireless mouse so I don’t even have to figure that thing out. Who has patience for that?

Pay CASH!

Cruise Sinking Fund Chart

If a cruise is in your future, I bet you can get ON BOARD with this!

The Cruise Sinking Fund Chart is here to help you save for your next vacation! After all, Sinking Funds will FLOAT YOUR BOAT! Okay! I’ll stop now!

Can you imagine the open waters, food prepared for you, fun destinations, and entertainment galore? Actually, I’ve never been on a cruise but that’s what I visualize when I think of one! Am I right? Now, imagine a paid for cruise. A cruise you’ve saved for and can take without accruing debt!

Sink your funds and float the boat! It’s the best way to vacation and relax, debt free!

Debt Free Chart

Are you ready to Crush Debt? A visual is a great way to keep your goal to stomp out debt, once and for all. Not just on payday. Use our Debt Free Chart in conjunction with our Debt Boss debt tracker to know where you stand on debt.

Our Debt Free Chart is FUN and easy to use! Tape it to the inside of a kitchen cupboard, you open often, to keep you motivated and on task!

Tell your Debt who’s Boss! Get your financial house in order and keep a visual of where you stand on debt. It’s YOUR time to Stomp Out Debt!

Disney Vacation Sinking Fund Chart

Have you been dreaming of a Disney Vacation? Guess what? We have a Disney Vacation Sinking Fund chart just for you!

It’s the Sinking Fund the whole family will get on board with!

Can you imagine a Disney Vacation where you come home without a stack of credit card bills? You can do this!

Emergency Fund Chart

Could you imagine the feeling of financial security That’s what Sinking Funds are for! We have an Emergency Fund Chart to help you on your road to financial security!

It’s the Sinking Fund that feels like a warm blanket on a cold winter’s night.

A fully funded Emergency Fund may seem like a pipe dream at this point. Don’t let that dissuade you from making a start! One small step at a time! You can do this! Financial security is waiting for you!

Garage Sales Sinking Fund Chart

Are garage sales a fun hobby for you and you want to make sure you have CASH to spend on your great finds? The Garage Sale Sinking Fund Chart will help you save all winter so you’re ready to roll when the garage sales hit!

Gifts Sinking Fund Chart

You absolutely know the date Christmas arrives. You also know when your friends and family have Birthdays to celebrate. Why do these events catch our budgets by surprise?

The Gifts Sinking Fund Chart will guide your spending plan and help you gain control of your gift spending!

Your Sinking Fund For Gifts will likely be an ever changing target as you use it for Christmas, Birthdays, Weddings, etc. That’s alright! We have the sinking fund for gifts just for that purpose. Once you reach a certain amount, you may be happy to stop contributing until the fund creeps back down.

Make Gift Giving FUN again!

Graduation Sinking Fund Chart

High School Graduation costs add up quickly. Don’t let it catch you off guard. Use this Graduation Sinking Fund Chart to prepare yourself for a whole bunch of Graduation FUN!

This is such an exciting time! Your little bundle of joy has almost made it through their school years and you are ready to CELEBRATE! All of that FUN comes with a price tag and you are ready to prepare for it.

Here are a few of the costs associated with graduation:

- senior portraits

- yearbook

- cap and gown

- announcements

- graduation outfit

- flowers or lei for graduation ceremony

- all night class party

- party invites

- party

- gift for the graduate

It’s time to Party! Your son or daughter’s graduation is worthy of a great celebration! Thank goodness you are smart and ready to save for this momentous occasion!

Home Maintenance Sinking Fund Chart

A Home Maintenance Sinking Fund is probably one of the most necessary Sinking Funds for homeowners. According to HGTV, you should set aside 1% – 3% of your home’s purchase price each year for Home Maintenance. That’s a LOT of dough! We’re talking $3,000 – $9,000 a year on a $300,000 home.

Even though a Home Maintenance Sinking Fund may seem like an unobtainable, HUGE goal, what if you started with 1%? Even .5%?

One thing is for sure, you won’t save a dime if you don’t plan. We’re here to help you plan with a Home Maintenance Sinking Fund Chart!

Make a Plan and use our Home Maintenance Sinking Fund Chart as a visual to keep you on track! You’ll be further ahead than you are now, right?

Honeymoon Sinking Fund Chart

Money is flying out the door in preparation for your wedding but have you saved for your honeymoon? The Honeymoon Sinking Fund Chart is a fun way to track your progress towards the honeymoon of your dreams!

If you are financially savvy, you won’t want to start married life on a honeymoon charged to a card. That means you gotta save and go on an awesome honeymoon you can pay cash for!

This is such and exciting time! Keep it happy with a honeymoon plan that doesn’t leave you in debt!

Kitchen Remodel Sinking Fund Chart

Do the glorious pictures of beautiful kitchens all over the internet have you ready to take the plunge? We actually have a beautiful kitchen BUT our home was built in the 90’s and the cabinets under the sinks smell. Flat out stink. As in I hate even opening the cupboard doors. I think perhaps the wood they used has gotten wet over the years and it’s just bad.

The thought of a kitchen remodel seems so far fetched because, you know, it isn’t cheap to remodel a kitchen. BUT I have hope!

Since you’re reading this right now, I’m going to assume you are fiscally responsible and want to remodel your kitchen with finances in place! The sooner you start to save, the sooner you will make your beautiful kitchen a reality!

I can imagine the day I open my cupboard under the sink and don’t cringe from the smell. It will be a happy day, especially if there’s no debt to go along with it!

Kitten Sinking Fund Chart

Have you decided to add a cat to the family but want to make sure you’ve got expenses covered?Our Kitten Sinking Fund Chart will give you the visual you need to save for the new addition to your family!

I know what you’re thinking. Why in the world would I need a Sinking Fund Chart for a Kitten? Can’t you find one absolutely free? Maybe. Maybe not. Even so, there are many costs associated with adding a new pet to the family.

One Time Expenses:

- spaying or neutering

- collar

- litter box

- scratching post

- crate

Annual Expenses:

- food

- medical exams

- litter

- toys

- treats

- pet sitter

According to this article, a cat can cost up to $1,070 the first year. That’s an amount worthy of a Sinking Fund Chart!

The excitement of adding a Kitten to the family must not overlook the financial implications of a new pet.

Pets add so much to a family! You NEED one! Seriously! You just gotta do the work to make sure you can provide for it financially.

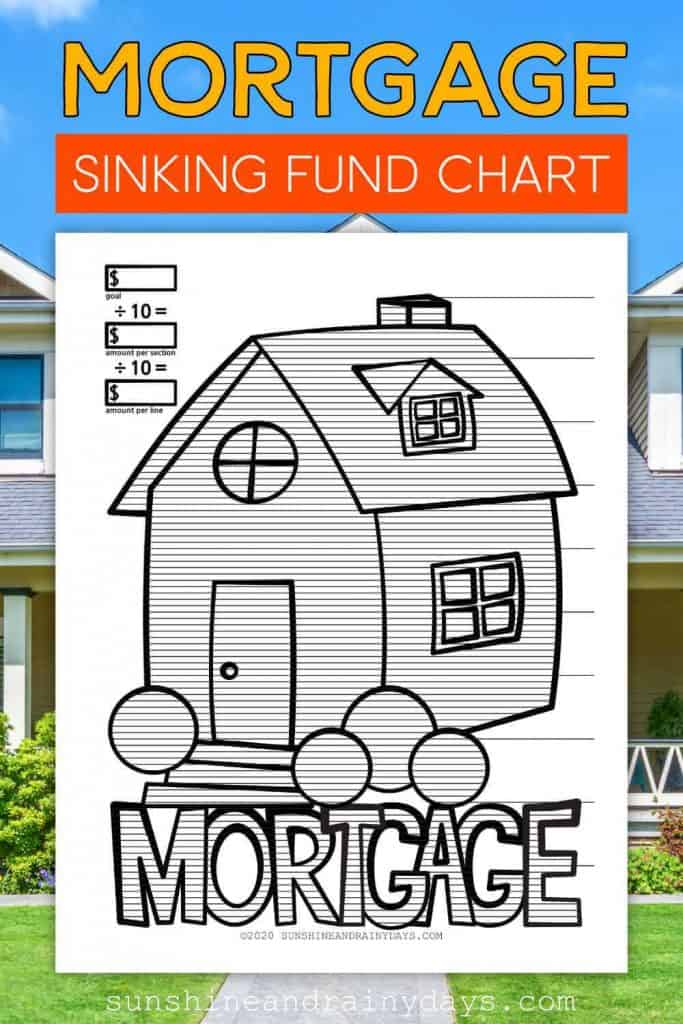

Mortgage Sinking Fund Chart

Are you ready to tackle your mortgage and pay off that house? How awesome would that feel? The Mortgage Sinking Fund Chart will give you the visual motivation to pay extra principal on your mortgage each month!

There are multiple ways you may choose to use the Mortgage Sinking Fund Chart and they are all the right way!

- To pay extra principal each year.

- To save for a down payment on a home and decrease your mortgage amount.

- To track the pay off of your mortgage.

Your mortgage may seem HUGE and daunting but breaking it down into smallish principal chunks will help you take years off your mortgage!

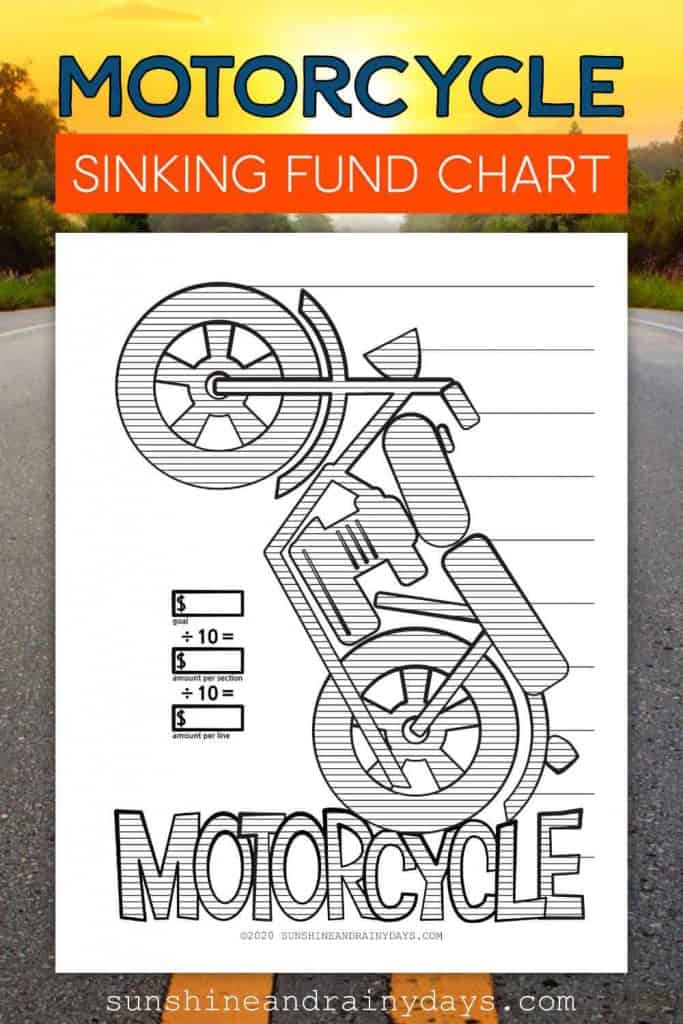

Motorcycle Sinking Fund Chart

Are you dreaming of the day you can ride footloose and fancy free on two wheels? Our Motorcycle Sinking Fund Chart will give you the visual you need to make your dream a reality.

A motorcycle sounds like a lot of Fun but what if your significant other isn’t on board? Here’s the deal, it might not be the right time to include a Motorcycle Sinking Fund in your budget. I’m just speaking the hard truth here.

If you’re super duper determined, although it’s not going to fit in your family budget, I suggest slowly chipping away with your allowance. After all, a motorcycle probably isn’t a necessity in your life.

Imagine arms stretched out to the handlebars, cool breezes against your skin, and the agility your bike will bring. Oh, and watch out for other drivers. Be safe out there.

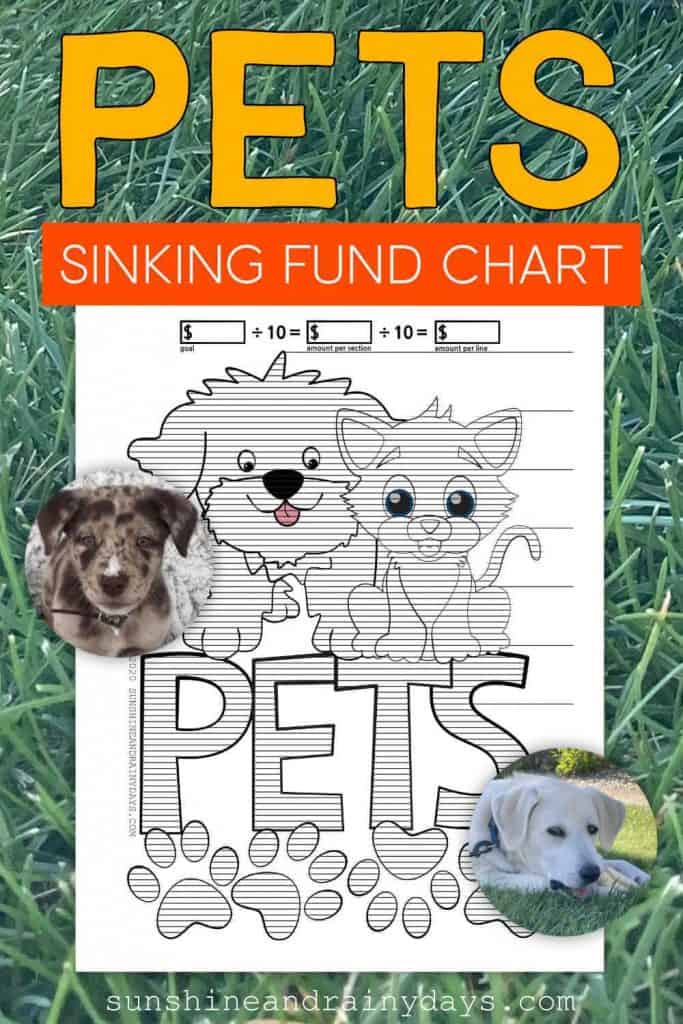

Pets Sinking Fund Chart

Are you ready to welcome a new friend into your home? The Pets Sinking Fund Chart will give you a visual to save so you aren’t caught off guard with the expenses that come with having a pet.

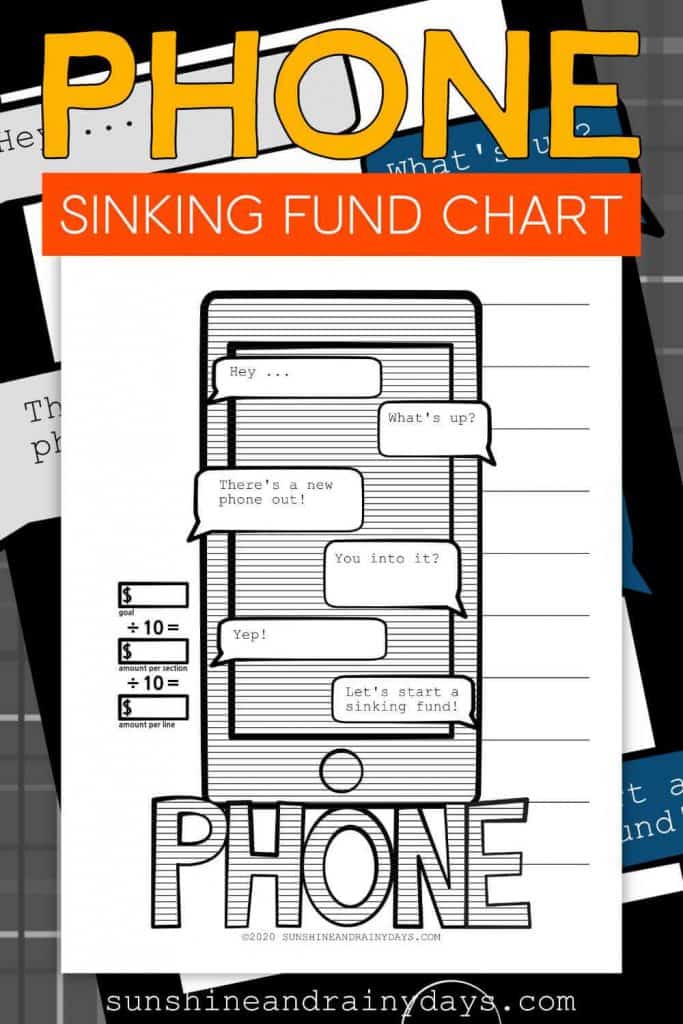

Phone Sinking Fund Chart

Do you have your eye on the latest and greatest phone? We’ve got a Sinking Fund chart for that! The Phone Sinking Fund Chart will encourage you to save CASH for your new phone!

There’s a new iPhone you are super excited about! BUT those things aren’t cheap. Rather than add payments to your already atrocious phone bill, you want to pay CASH! Let us help with the Phone Sinking Fund Chart!

A few years ago, I was sporting the iPhone 4S in a massive OtterBox. That thing was pristine but it had issues. Issues like not dinging when a text was received or not showing me texts at all. You know the drill … slowly but surely phones lose their oomph and need to be replaced. Seven is my favorite number so I saved my allowance for months in anticipation of a shiny new iPhone 7 Plus. Texts were sporadic but I could make phone calls! I could make it work!

Eventually, I saved enough to purchase that new iPhone 7 Plus and it felt GREAT to pay CASH! I didn’t touch the family spending plan. Nope! I did it all on my own with my $100/month allowance! I gave up new clothes, shoes, and eating out in order to get that shiny new phone!

Are you ready to pay CASH for a new Phone? You totally got this!

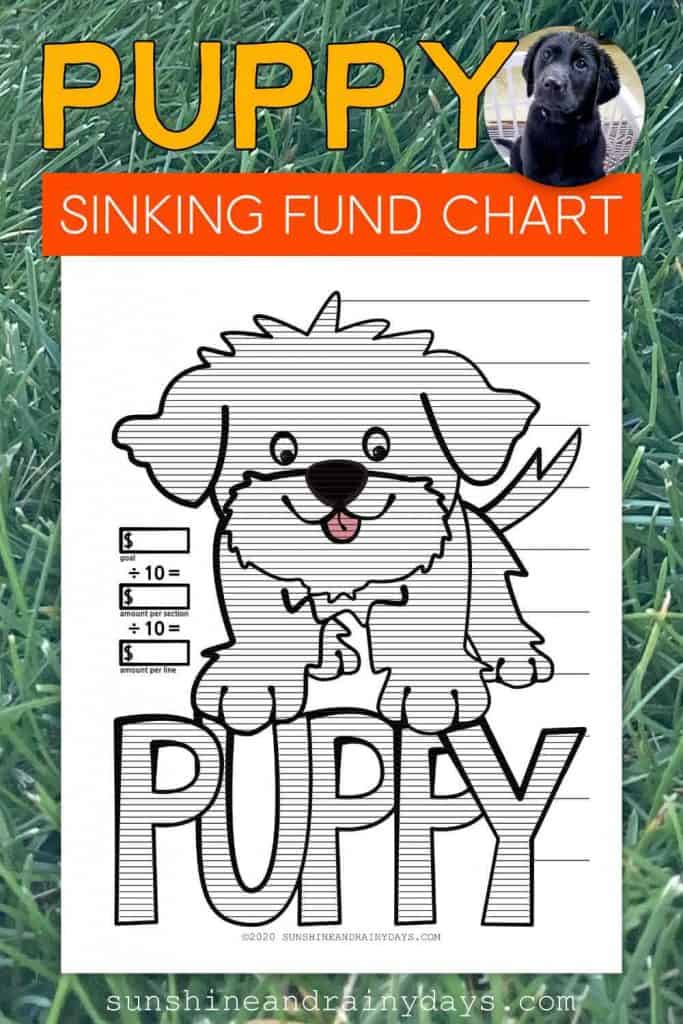

Puppy Sinking Fund Chart

Have you been looking to add a puppy to the family but the costs astound you? Our Puppy Sinking Fund Chart will give you the visual you need to save for your new pet!

When my daughter was in third grade (she’s a senior now), she desperately wanted a pet. Since my husband and son are both allergic to fur, we did a lot of research into pets we could all live happily with … and be able to breath around. We had had fish and considered a bigger tank with a larger variety of fish but my daughter wanted a pet she could play with. We contemplated a tortoise but quickly realized the space a tortoise would require was more than we had to spare. A dog seemed much simpler but what about the allergies? THEN, we discovered hypo-allergenic dogs were a thing! Would a hypo-allergenic dog really work though?

We told our daughter if she saved enough to buy a hypo-allergenic dog, she could have one! Hypo-allergenic dogs aren’t cheap! Justine saved every last cent she had until she had $450. That girl was determined! She is now the proud owner of an 8-year-old Shihtzu Bichon whom our family adores!

Thankfully, the boys in the family have never had an allergic response to TeddiBear!

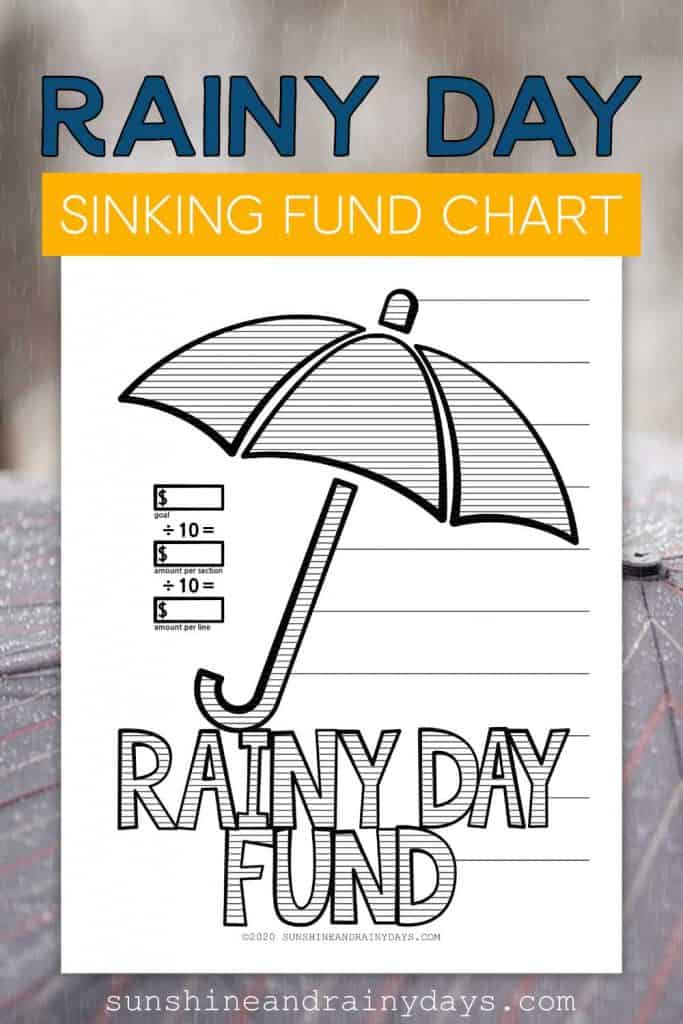

Rainy Day Sinking Fund Chart

The Rainy Day Sinking Fund Chart is here to act as the middleman between your spending plan and emergency fund.

Rainy Days equal a dark sky, rain, and no desire to do anything but curl up on the couch with a warm blanket and a good book.

A Sunny Day energizes you. The day is long and your motivation high.

Oftentimes, we will use the abundance of motivation we have on the sunny days to prepare for the rainy days. Here, in the Pacific Northwest, we cherish the sunny days. Those are the days we get the yard work done, wash the cars, hike, bike, and get out and have fun. We are sure to enjoy the sunny days because we know the rain will come.

How does that relate to money?

When things are going well and you have more than enough, save it for a rainy day when things are a little tough. Hey! That rhymed!

Many people think of a Rainy Day Fund the same as an Emergency Fund. I like to think of it as the Emergency Fund’s younger sibling. It’s the fund you can go to when something pops up unexpectedly. Like you lose your glasses or get a ticket from one of those cool cameras at popular intersections … ahem.

I don’t know about you but it really bothers me to have to dip into the Emergency Fund. A Rainy Day Fund? It’s like the middleman. The fund that ebbs and flows.

The Rainy Day Fund is the fund that keeps you free from stress over the unexpected little stuff because … you got it covered … get it? Covered like an umbrella covers … hey, I tried!

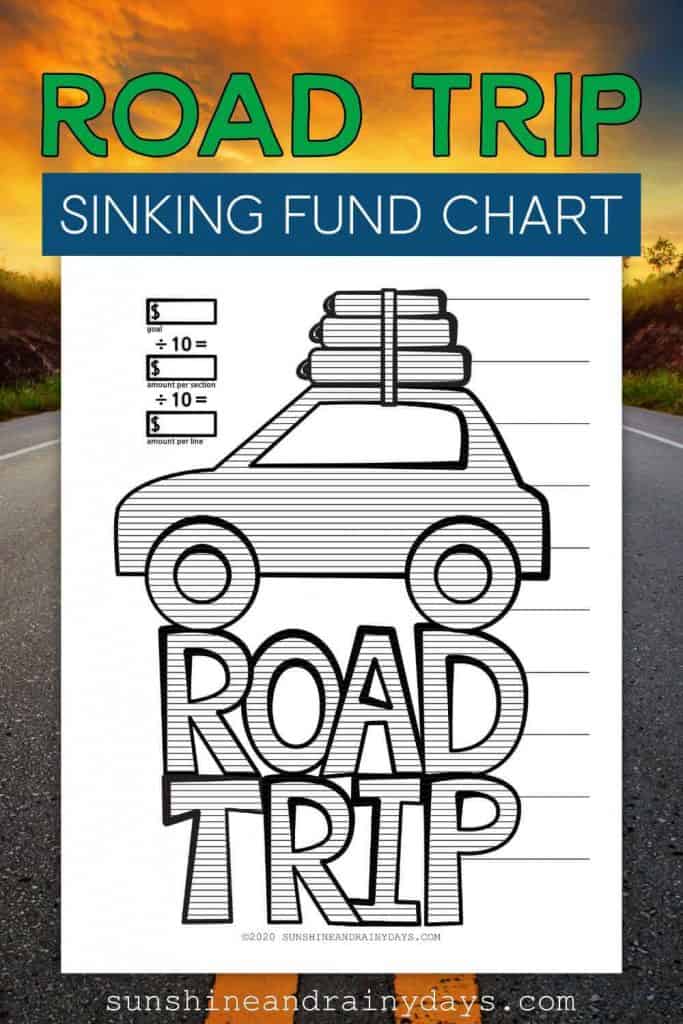

Road Trip Sinking Fund Chart

Road Trips are what family memories are made of! The good, the bad, the boredom, the excitement, and everything in between!

The BEST kind of Road Trip is the one that’s paid for before you set foot out the door! Our Road Trip Sinking Fund Chart will give you motivation to make that Road Trip a reality!

Imagine the pure JOY you will experience on your next Family Road Trip knowing it’s paid for! There will be no need to add debt to your lives because you’ve planned! The wide open road is waiting for you!

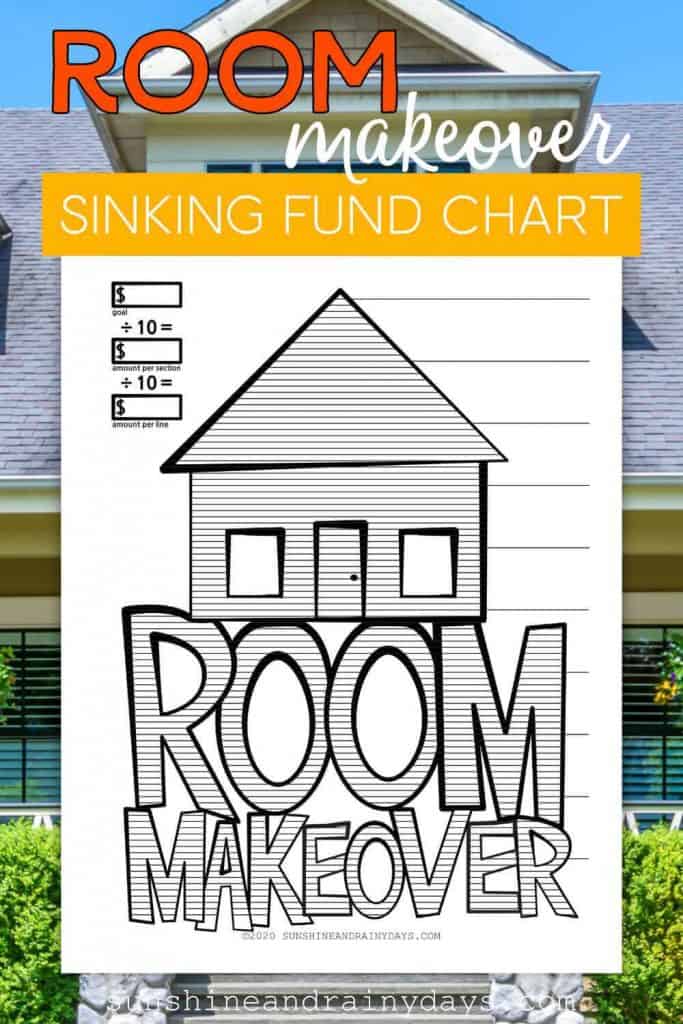

Room Makeover Sinking Fund Chart

We have put decorating our new home on the back-burner because, you know, there is so much to save for. Am I right?

I’m giddy with excitement because you all know how I like to create sinking fund charts! This time I created a Room Makeover Sinking Fund Chart!

Won’t it feel good to pay cash for your new room makeover?

School Clothes Sinking Fund Chart

School Clothes could break the bank but the School Clothes Sinking Fund Chart will give you motivation to save and pay cash for your back to school shopping spree!

Ah! Back to school shopping is so much fun! I remember the days of laying all the new clothes out on the kids’ beds and taking a picture for their yearly picture books!

A budget and cold hard cash will help your students work within their perimeters when it comes to school shopping.

Use this Back To School Clothes Inventory And Shopping List Printable to help your student make their dollars stretch where they are needed most!

Sports Sinking Fund Chart

Sports are so important for our kids but they aren’t cheap. Use the Sports Sinking Fund Chart to SAVE for sports!

Study Abroad Sinking Fund Chart

Do you or your college kid want to Study Abroad? The Study Abroad Sinking Fund Chart is here to help you save CASH for your dream to study in another country!

My daughter has her sights set on a year long Study Abroad program her sophomore year. She’s getting all her ducks in a row and even asked if I could make a Sinking Fund Chart!

This mom’s heart doesn’t know if I can take my daughter going to another country for an entire year but I am so proud of my girl and her intense drive!

Update: She did it! Justine studied in Austria her sophomore year of college and we all survived … although she had to leave early because … 2020.

Swimming Pool Sinking Fund Chart

Is it time to add a major addition to your backyard? The kind of addition that draws family and friends together on hot days? It’s time to start a Sinking Fund! The Swimming Pool Sinking Fund Chart is a fun way to track your progress toward splashing family fun!

There’s nothing like the convenience of a swimming pool in your own backyard on hot summer days! That swimming pool is even better when it’s paid for in cash!

Television Sinking Fund Chart

Is it time for a new television? The Television Sinking Fund Chart is here to help you save CASH for that new big screen TV!

Imagine my surprise when I heard a friend talking about my big, flat screen television. The thing is 32″ tops! As a matter of fact, many people have commented, ‘now you just need a big screen television’, when visiting our new home for the first time. Even contractors have made the same comment when bidding jobs. Really!

Yes, a big screen television is on the list of Stuff We Want but, I have to admit, it ranks way down there with new doorknobs to replace the gold ones that were once so popular.

But maybe you’re ready? I just read in the Costco Connection about OLED televisions. They just keep getting better! A big screen television is important to a lot of people. It’s like a sign you’ve really made it in this world. It’s like a trophy you hang above the fireplace that says, WE MADE IT. We’re rolling in the dough! Ha! Picture this … a big screen, trophy television you paid cash for! THAT’S where it’s at!

Oh … and I’ll keep my friend that thinks my 32″ is huge!

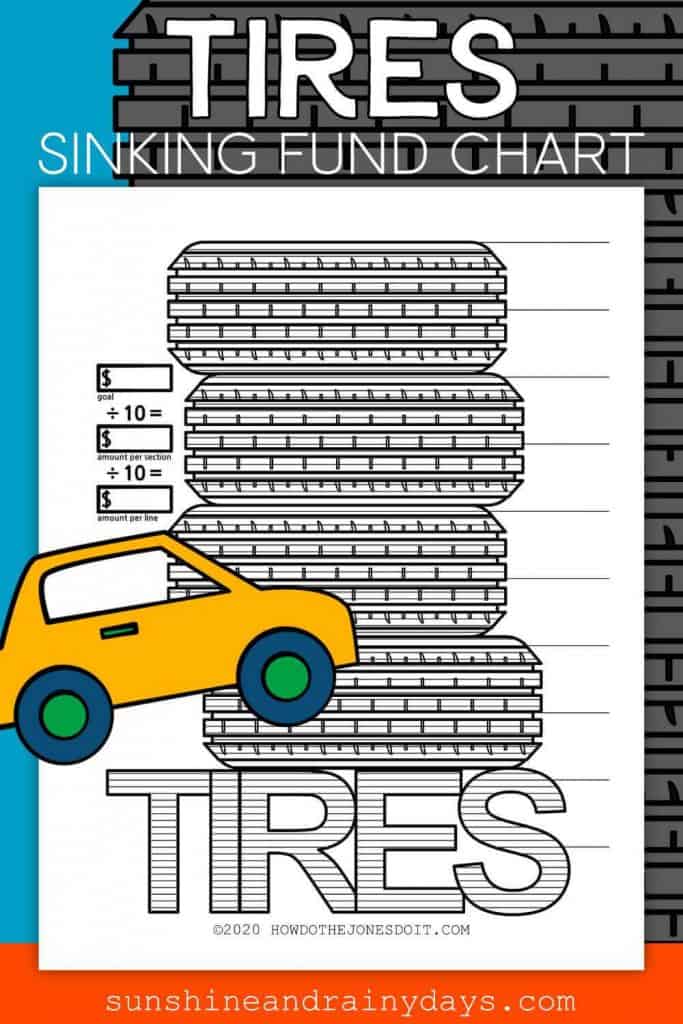

Tires Sinking Fund Chart

The BEST time to start a Tires Sinking Fund is when you DON’T need tires! The second best time is NOW! Start your Sinking Fund now so you don’t get caught with bald tires and no cash!

How To Know When It’s Time To Replace Your Tires

Have you tried the penny test? Check out this video to know if it’s time to replace your tires.

Need a place to keep the cash you’re saving for new tires? Check out this Tires Cash Envelope!

Vacation Sinking Fund Chart

Of all the Sinking Funds you choose to have, the Vacation Sinking Fund is probably the most FUN!

It’s the Sinking Fund you can totally look forward to filling in the lines because that means you’re that much closer to Vacation!

If you have 10 months before you take off for vacation and your vacation will cost $3,000, that means you need to incorporate $300 a month into your spending plan.

Can you imagine a vacation where you come home without a stack of credit card bills? You can do this!

Visa Sinking Fund Chart

Can you imagine the day you are debt free? It starts right here with your first step. The Visa Sinking Fund Chart will help you track your way to debt freedom!

You plan to pay your Visa off at the end of each month but that little thing is so easy to use and, before you know it, you’ve charged more than you can pay. It’s time to show that little rectangle piece of plastic who’s boss with the Visa Sinking Fund Chart!

Add the Visa Sinking Fund Chart to your Financial Binder and feel the weight lift as you color in the lines to debt freedom!

Wedding Sinking Fund Chart

You’ve done it! You’ve committed to the person of your dreams and now it’s time to plan your wedding. Not just any wedding. Nope! Your wedding will be smart on your finances because you plan to use a Sinking Fund! You and your fiancé are savvy folks and will have the wedding of your dreams, within your means, by using the Wedding Sinking Fund Chart to help you save!

According to The Knot, the national average cost of a wedding in 2017 was $33,391. Say WHAT? According to this report, couples have decreased the number of guests they invite but the average cost per guest has reached $268.

You have GOT to be kidding me! Let me just say I would NOT want a new couple to spend $268 for me to attend their wedding. Let’s get back to simple!

All opinions aside, the Wedding Sinking Fund Chart is here to help you save CASH for your wedding, whether it’s a frugal or elaborate one.

Get creative with a wedding that is meaningful to YOU and your fiancé! This isn’t a competition. It’s a beautiful day to celebrate with family and friends whom would rather see you start life together debt free than be lavished with entertainment and fancy food.